Review of Zero Currency — Dec. 7, 2018

This is not financial advice. I am not a financial adviser. If you take any or everything that I say to you as professional advice, you might get rekt. You’ve been warned. #DYOR

Continuing our series on Privacy coins, this week’s Coin of the Week is Zero.

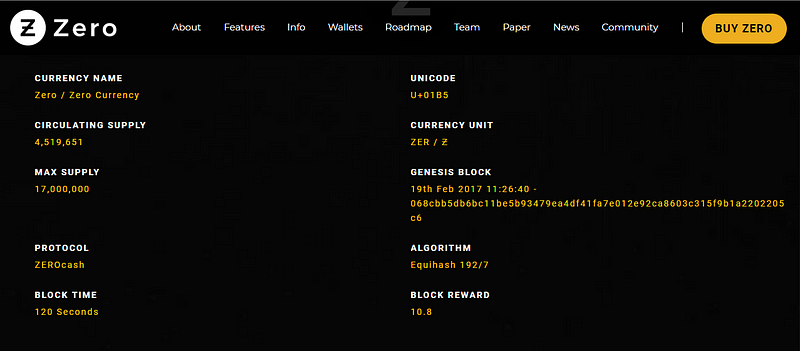

Zero bills itself as “ a revolutionary cryptocurrency and transaction platform based on ZCash”. While there are a ton of currencies and tokens that make this claim, this one is credible. I love the fact that it has rapid transaction times and that the transactions are inexpensive; sometimes even free. At full capacity, the Zero blockchain charges as little as 0.0001 $ZER. When the network is not at full capacity, the fee is 0. I don’t know about you……but 0 is always good for me.

Fundamentals:

$ZER is run as PoW and is ASIC resistant. Because of zk-SNARK implementation for privacy, $ZER offers shielded transactions and anonymity in sending funds. It runs on a large and relatively decentralized network meaning it offers decentralized payments; even on mobile wallets. I really like $ZER because there was no pre-mine or ICO. This means everyone is on a level playing field when it comes to mining and investing. Also, Zero has a low inflation rate. These things make it enticing to investors who are looking for a long term hodl as opposed to day traders seeking PIP’s.

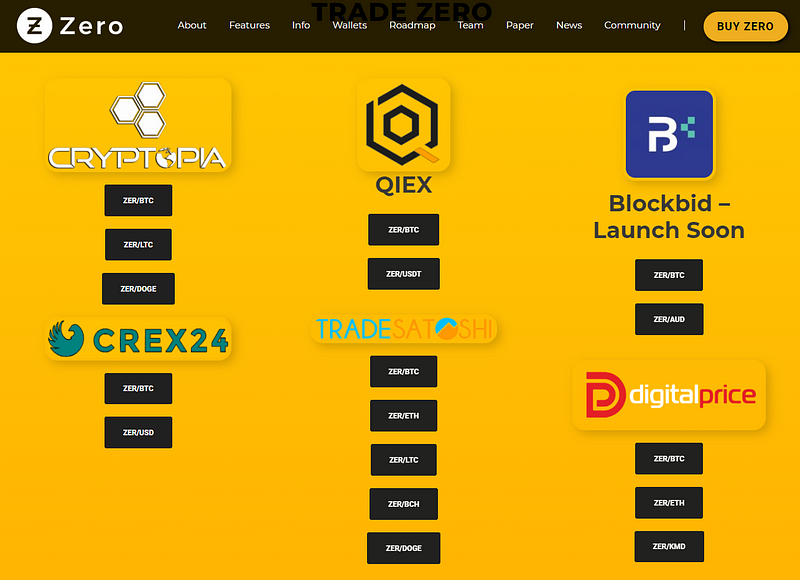

You can find it on a ton of centralized and decentralized exchanges. Cryptopia, Qiex, Crex24, TradeSatoshi, DigitalPrice, and others. But most importantly you can find it on decentralized exchanges like Komodo and soon on my favorite exchange, Bisq. They have a ton of wallets for both mobile and desktop platforms.

$ZER is run as PoW and is ASIC resistant. Because of zk-SNARK implementation for privacy, $ZER offers shielded transactions and anonymity in sending funds. It runs on a large and relatively decentralized network meaning it offers decentralized payments; even on mobile wallets. I really like $ZER because there was no pre-mine or ICO. This means everyone is on a level playing field when it comes to mining and investing. Also, Zero has a low inflation rate. These things make it enticing to investors who are looking for a long term hodl as opposed to day traders seeking PIP’s.

You can find it on a ton of centralized and decentralized exchanges. Cryptopia, Qiex, Crex24, TradeSatoshi, DigitalPrice, and others. But most importantly you can find it on decentralized exchanges like Komodo and soon on my favorite exchange, Bisq. They have a ton of wallets for both mobile and desktop platforms.

Technicals:

Charting Indicators used: Simple Moving Average 50, Enhanced Moving Average 50, Bollinger Bands set at 20, Relative Strength Index 21 and Stochastics. In a 3 month view, the charts appear sideways to the naked eye. But when adding SMA, EMA, and BB20 we see that $ZER is trending slightly upward in value. On October 22nd, we saw a nice large candle and the value increase almost 50%. Since then we’ve seen a steady decline in volume and value. Based on our 3-month view we are also seeing $ZER trending toward overbought territory.

Charting Indicators used: Simple Moving Average 50, Enhanced Moving Average 50, Bollinger Bands set at 20, Relative Strength Index 21 and Stochastics. In a 3 month view, the charts appear sideways to the naked eye. But when adding SMA, EMA, and BB20 we see that $ZER is trending slightly upward in value. On October 22nd, we saw a nice large candle and the value increase almost 50%. Since then we’ve seen a steady decline in volume and value. Based on our 3-month view we are also seeing $ZER trending toward overbought territory.

Comments

Post a Comment