Review of Deviant Coin - 11/02/2018

Before I get started, I want to remind everyone that this is not financial advice. I am not a financial advisor. If you take anything that I say to you as truth, you may get #rekt. Do Your Own Research #dyor

What is Deviant Coin $DEV?

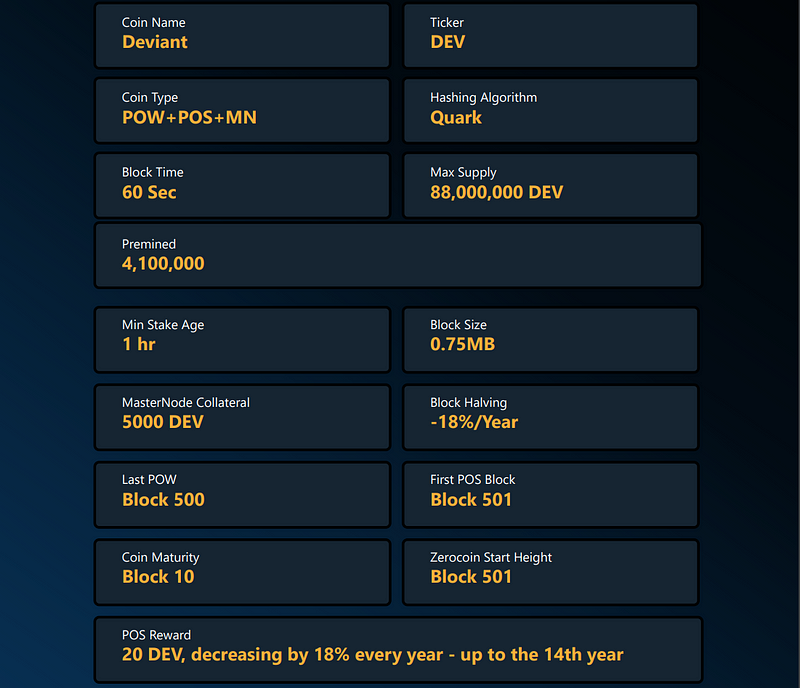

Deviant Coin is a POW/POS/Masternode currency based on privacy and fungible liquidity. Their goal is to provide a secure mode of sending crypto to anyone in the world. I, unfortunately, was unable to locate information on their founders or developers; but, I do know that they have an extensive Bitcointalk thread that starts roughly in February 2018. $DEV is a Pivx/Dash based fork that has implemented the ZeroCoin protocol. This is primarily a POS blockchain but the first 500 blocks were mined using POW through the Quark algorithm. A total of 4.1 Million $DEV were pre-minded for infrastructure development.

The $DEV wallet offers secure transactions, encrypted messaging, anonymity through stealth wallet addresses, low confirmation requirements, and low fees. You can find wallets for just about every platform. Ubuntu, Windows, Mac, and Android.

Privacy:

Most blockchains have public ledgers. You can go to any block explorer for that coin/token and see all transactions. This is really good from a transparency and accountability perspective. But, when it comes to privacy coins this is not at all welcomed. The ability to use a block explorer to see “EVERY” transaction means there is no real privacy or anonymity when using that coin. There is only partial anonymity. This is the reason $DEV uses the ZeroCoin protocol with the DarkSend feature. What is DarkSend you ask? DarkSend is a coin-mixing service based on CoinJoin that mixes coins using similar denominations as others. Because it uses those similar denominational outputs, it is able to hide most transactions and ensure fungibility. DarkSend is incorporated into each masternode and provides this coin-mixing utility.

Most blockchains have public ledgers. You can go to any block explorer for that coin/token and see all transactions. This is really good from a transparency and accountability perspective. But, when it comes to privacy coins this is not at all welcomed. The ability to use a block explorer to see “EVERY” transaction means there is no real privacy or anonymity when using that coin. There is only partial anonymity. This is the reason $DEV uses the ZeroCoin protocol with the DarkSend feature. What is DarkSend you ask? DarkSend is a coin-mixing service based on CoinJoin that mixes coins using similar denominations as others. Because it uses those similar denominational outputs, it is able to hide most transactions and ensure fungibility. DarkSend is incorporated into each masternode and provides this coin-mixing utility.

Proprietary Exchange:

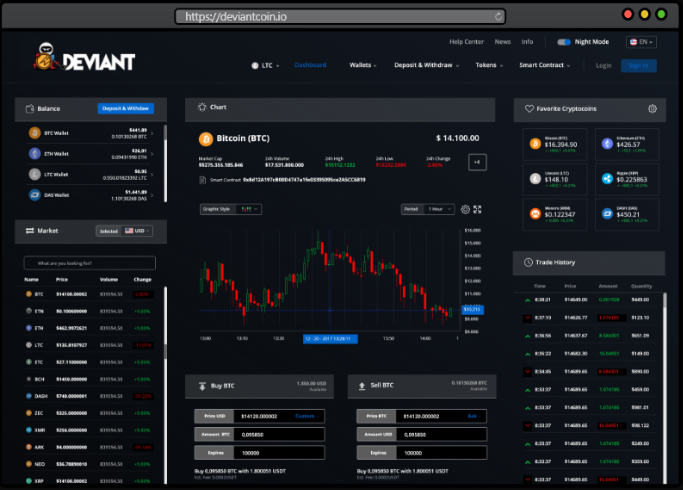

Ok, we now know that $DEV is POS and backed my masternodes for security, privacy, anonymity, and fungibility. That’s cool….but the thing I like the most about this project is the proposed exchange they are building. Called DEVX, it plans to be the hybrid first exchange to offer 3-factor authentication. Yes….you read that right. Hybrid and 3FA. It will be a hybrid exchange because they will leverage smart tokens on the Bitshares blockchain. They will be a 3FA exchange because they plan to incorporate a hardware device to function as a third layer of authentication security in addition to passwords and third-party authentication apps like Google or Authy. This hardware device will function as both an additional layer of authentication and as a hardware wallet for storing tokens on the DEVX exchange. The hardware wallet will support multi-sig addresses for use on the exchange via the DEVX protocol. The device is scheduled to be released in Q3 of 2019. If nothing else can be said about the DEVX exchange, it will be secure AF!

Ok, we now know that $DEV is POS and backed my masternodes for security, privacy, anonymity, and fungibility. That’s cool….but the thing I like the most about this project is the proposed exchange they are building. Called DEVX, it plans to be the hybrid first exchange to offer 3-factor authentication. Yes….you read that right. Hybrid and 3FA. It will be a hybrid exchange because they will leverage smart tokens on the Bitshares blockchain. They will be a 3FA exchange because they plan to incorporate a hardware device to function as a third layer of authentication security in addition to passwords and third-party authentication apps like Google or Authy. This hardware device will function as both an additional layer of authentication and as a hardware wallet for storing tokens on the DEVX exchange. The hardware wallet will support multi-sig addresses for use on the exchange via the DEVX protocol. The device is scheduled to be released in Q3 of 2019. If nothing else can be said about the DEVX exchange, it will be secure AF!

Technical Analysis ***NOT FINANCIAL ADVICE***

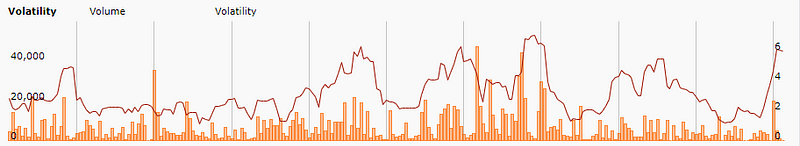

1 Month snapshot using 50-day Simple Moving Average, 50-day Exponential Moving Average, Bollinger Bands at 20 days with both Stochastics and Volatility indicators. We see a cross of the EMA and SMA around the 27th of October that began an upward trend in price for the coin. A tightening of the Bollinger Bands on the 30th and another bullish cross of the EMA and SMA have kept the upward momentum going. There is still a little wiggle room in the Stochastics to make a short term profit if you decide to enter based on these charts but I would look for a pullback in a week or so. If volume increases or the price of $BTC begins to climb, my initial assessment may be incorrect. I currently see resistance at 0.00004261 $BTC. We’ve touched it 3 times in the last 2 weeks. If we break resistance, I believe that 0.000045 BTC will be the new line of support. It’s been moving sideways since August so there is no telling where it will end up. These are just my thoughts. ***NOT FINANCIAL ADVICE***

Conclusions:

All in all, I think Deviant is a good project. It’s a different spin on Privacy coins that rely on POW to secure the network. Down 96.2% from its ATH and sideways action for the last few months, I believe $DEV would be a good addition to any portfolio.

Resources:

https://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:moving_averages

https://www.coingecko.com/en/coins/deviant-coin/historical_data/usd?end_date=2018-11-02&start_date=2017-11-02#panel

https://bitcointalk.org/index.php?topic=2960430.0

https://www.investopedia.com/terms/c/coinjoin.asp

https://deviantcoin.io/whitepaper_coin.pdf

https://deviantcoin.io/

https://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:moving_averages

https://www.coingecko.com/en/coins/deviant-coin/historical_data/usd?end_date=2018-11-02&start_date=2017-11-02#panel

https://bitcointalk.org/index.php?topic=2960430.0

https://www.investopedia.com/terms/c/coinjoin.asp

https://deviantcoin.io/whitepaper_coin.pdf

https://deviantcoin.io/

Comments

Post a Comment