Review of Fortuna $FOTA 10/07/2018

Review of Fortuna $FOTA 10/07/2018

Before I get started, I want to remind everyone that this is not financial advice. I am not a financial advisor. If you take anything that I say to you as truth, you may get #rekt. Do Your Own Research #dyor

What is Fortuna (FOTA)? I plan to give you an overview of the project and include both critical Fundamental Analysis and a simple Technical Analysis.

Fundamental Analysis:

Fortuna (FOTA) token is designed to streamline and make efficient the Over-the-Counter(OTC) derivatives market. They do this by using the proprietary consensus algorithm DPOSA. DPOSA, Delegated Proof of Stake, is a consensus algorithm designed to ensure data integrity and prevent unwanted manipulation. As long as malicious nodes do not control 1/3 of the network, there will be no unwanted forks. In addition to DPOSA, they also use a proprietary decentralized quoting system. For more information on DPOSA and their decentralized quoting systems, please read the full whitepaper here.

Competition:

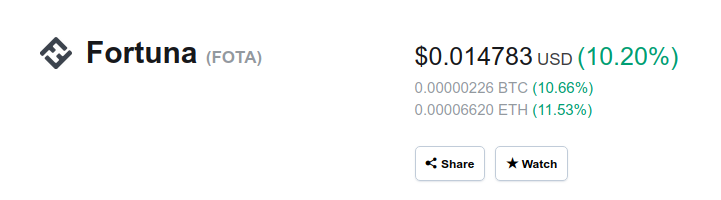

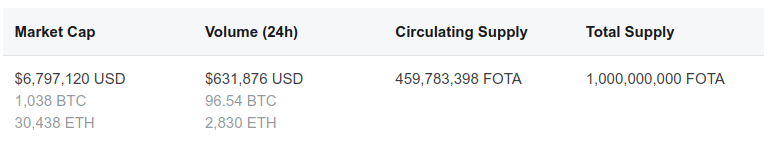

I wasn’t able to find a project that pairs exactly with $FOTA. I did find some projects that are relatively similar. Projects like Bitfair ($XBF), HiveEx and the Dynamic Rate Cash Transaction (DRCT) Token all offer similar functionality. None of these tokens are currently listed on CMC other than FOTA. Fortuna is currently up 10% at the time of writing is listed at 226 satoshis. I would normally stay away from coins or tokens with less than half of the coins in circulation; but, this is the first coin of it’s kind to be listed on CMC and the project looks good. The maximum supply of tokens is 1,000,000,000 with a current circulating supply of 459,783,398 FOTA.

It is almost impossible to gauge future price based on the fundamentals of this token because there aren’t many like it. What I will say is that there are currently only 16 coins/tokens on CMC that have a market cap > $1 Bill. In my opinion, based on fundamentals, if you are willing to hodl this token for a little while, you could make a nice profit. Investing today at 226 satoshis and #hodling to 2260 satoshi would give you a 10x return on investment. This would make the USD price roughly $0.11. Now let's do a little simple TA and determine the best entry point.

Technical Analysis:

As an investor, not a trader, I look specifically at long term trends on coins/tokens I investigate. The setup below is with a 50 Simple and Exponential moving average. Bollinger Bands set to 20. This a 6-month breakout with 24hr candles. As seen below, based on the MACD, we are currently moving out of oversold territory and moving into a more bullish position. Widening of the Bollinger bands indicates that the volatility doesn’t show any major price movements in the near future. (of course, I could be wrong) So you shouldn’t have to worry about losing your bag to bears the minute you buy. We can see a crossing of the Simple and Exponential moving averages occurring that is bullish on the 1-month zoom in. As we are moving out of bearish territory, as indicated by current volume, I would look to enter this market now at 229 satoshis with stop losses set at 220 and 209 to catch any minor dips. I’m not a day trader so I won’t offer a time to pull a profit. Just monitor this daily to see where you are comfortable.

Conclusion:

Crypto is the wild wild west of investing. There is no “sure thing”. But what I believe is that this is a fairly decent project. I would not advise going all in on any token/coin. I am a little leary at the lack of Github activity and community engagement; but, that may be due to my tools not accurately monitoring Chinese markets. If you are willing to buy and hodl, this token will be the one that all other OTC derivative tokens will be measured against for the foreseeable future. This is not investment advice. Make sure you do your own research.

Sources:

Comments

Post a Comment